Table of Contents

Warren Buffett is one of the most followed and studied investors in history. He has led the investment conglomerate since 1965 Berkshire Hathaway and helped generate a total return of 4,384,748%.

It’s fair to say that Buffett knows a thing or two about picking stocks. Some of the features of Buffett’s portfolio include financial services, energy companies and consumer goods companies. One sector that Buffett in particular stayed away from for years is technology.

However, in 2016, the Oracle of Omaha made a splash by unveiling a huge position in the world Apple (NASDAQ: AAPL). Less than a decade later, the iPhone maker is now Buffett’s largest holding – worth roughly $135 billion and accounting for nearly 41% of his total portfolio.

Let’s take a look at why Buffett likes Apple stock so much, and assess whether this is a good time for investors to pick up some shares.

Buffett’s investment philosophy is surprisingly simple

You don’t have to be good at picking individual stocks to emulate Buffett’s success. In fact, much of Buffett’s investment philosophy revolves around exercising patience and discipline, rather than identifying the “next big thing.”

In addition to Apple, some of Buffett’s largest holdings also include Coca-Cola, American Express, Western petroleum, bank of AmericaAnd Chevron. The first important point to recognize here is that Buffett is well diversified.

What’s more important, though, is looking at how long Buffett has owned some of these companies. For example, Buffett has owned Coca-Cola shares since 1988. Although Coca-Cola may be seen by many as a run-of-the-mill company, Buffett has delivered generous returns over the decades thanks to Coca-Cola’s reliable, steady growth and dividend program.

Apple, however, is a slightly different story. Buffett has owned Apple stock for less than a decade, and yet it has already grown into his largest position.

Clearly, Apple has experienced an excessive price increase in recent years. With artificial intelligence (AI) in the spotlight in the tech sector, could investors now be looking at a generational opportunity at Apple?

Apple’s AI strategy has been revealed

Over the past few years, many big tech companies have made great strides in the field of AI. Microsoft has made a $10 billion investment in OpenAI, the developer behind ChatGPT. Moreover, Alphabet And Amazon each invested in an OpenAI competitor, Anthropic.

The common thread connecting these investments is that Microsoft, Amazon and Alphabet compete fiercely in the cloud computing landscape.

Unlike its peers above, Apple has remained suspiciously quiet when it comes to its AI ambitions. Given that of the company sales have fallen I’ve found the lack of an AI roadmap unnerving for about a year.

But about a month ago, management finally gave investors a taste of Apple Intelligence — the company’s long-awaited strategy around AI — at the Worldwide Developers Conference (WWDC).

Apple is teaming up with OpenAI to integrate ChatGPT into its range of hardware products as it aims to bring AI-powered applications to the masses.

Apple’s WWDC took place from June 10 to 14. And since June 10, Apple shares are up 16%.

Unsurprisingly, many Wall Street analysts have also revised and upgraded their price targets for Apple stock over the past month.

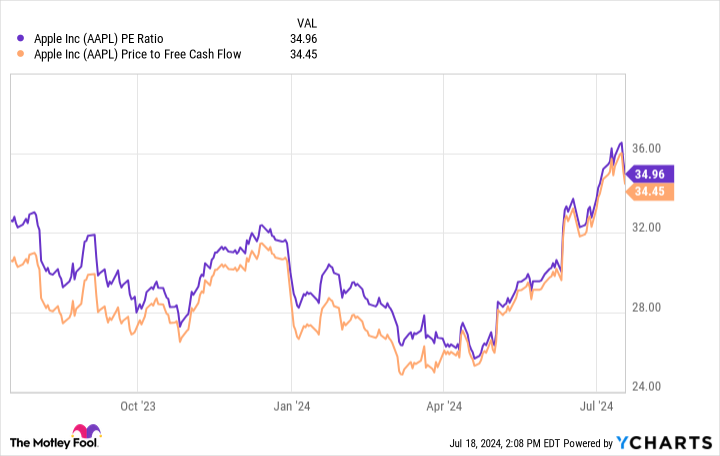

As the chart below shows, Apple’s price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) ratios are significantly higher today than they were just a year ago. It’s hard for me to justify these premium multiples as Apple has shown little growth or innovation for quite some time.

On the surface, it appears that investors are encouraged by the bullish sentiment surrounding Apple Intelligence, which has led to significant buying activity in the stock. While it may be tempting to follow, buying momentum is rarely a good strategy.

Another aspect that makes Buffett such a great investor is that he is contrarian. Buffett does not follow the crowd and does not chase high valuations.

While Apple Intelligence is an intriguing development, the company has yet to show any tangible results from it. Additionally, the first Apple Intelligence product suite won’t be released until this fall.

To me, it seems like investors are becoming more invested in the Apple Intelligence story, and that the current excessive buying activity is rooted in emotional hype rather than prudent logic.

While the rising price of Apple stock is good for Berkshire and Buffett, I don’t think it’s justified at this point. Should the company show a revenue turnaround, and perhaps turn Apple Intelligence into a major source of growth later this year, picking up shares could be a good idea. But for now, I wouldn’t take a position at Apple or add to an existing position.

Should You Invest $1,000 in Apple Right Now?

Before you buy shares in Apple, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns July 15, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. American Express is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple and Microsoft. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Bank of America, Berkshire Hathaway, Chevron and Microsoft. The Motley Fool recommends Occidental Petroleum and recommends the following options: long January 2026 calls at $395 at Microsoft and short January 2026 calls at $405 at Microsoft. The Motley Fool has one disclosure policy.

Billionaire Warren Buffett has invested $135 billion in just one artificial intelligence (AI) stock. Is it time to buy? was originally published by The Motley Fool