Table of Contents

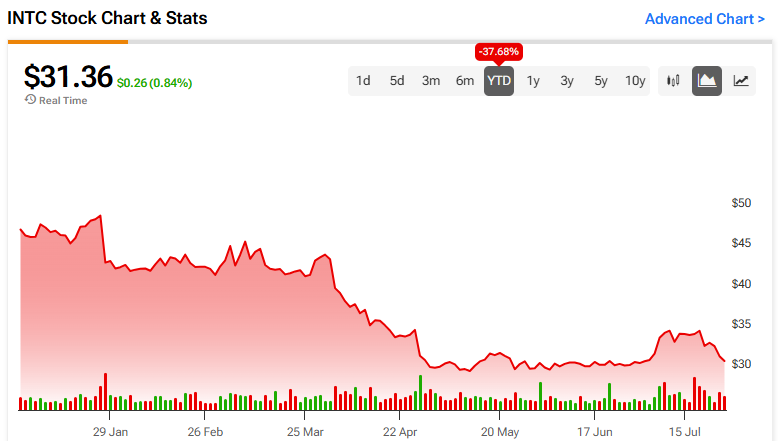

Intel (INTC) has underperformed its competitors in the chip manufacturing world in recent months and years. A decline of 37.7% since the beginning of the year 32% over five yearsThe stock’s valuation is starting to look quite attractive based on the expected growth in Client Computing Group (CCG) and Data Center and AI Group (DCAI). I’m bullish on Intel, with the company trading at 30.3x non-GAAP forward earnings and a price-to-earnings-growth (PEG) ratio of 0.6x (1.0x or less is generally considered undervalued).

Intel’s failures

Intel has struggled to keep up with its competitors in several respects in recent years, and analysts have noted several shortcomings under CEO Pat Gelsinger. The first of these is Microsoft’s (MSFT) decision to migrate away from Intel in favor of Qualcomm (QCOM) for its new Surface Copilot+ PC devices. This perhaps highlights Intel’s lagging performance in PC processors.

In December, Intel launched its Meteor Lake processors to much fanfare. Despite being the first Intel chipset with a Neural Processing Unit (NPU) to support AI and a combined CPU/GPU architecture, its measured artificial intelligence (AI) performance was only 34 TOPS (tera AI- operations per second). For reference, Microsoft had mandated over 40 TOPS for the NPU alone.

In response to this negative feedback, Intel has continued with the early announcement of its Lunar Lake chips, which feature 100+ Platform TOPS and 45+ NPU TOPS. However, some analysts have suggested that the second shortcoming is the inability to match the power efficiency of the Qualcomm X Elite series and the need to use Taiwan Semiconductor Manufacturing. (TSM) for production.

Finally, Intel’s foundry business has seen a decline in external revenues. While there’s nothing wrong with focusing on meeting Intel’s own needs from its foundries, it’s perhaps telling that external revenues have fallen. Even Intel uses TSMC’s foundries for its 3nm processes.

Intel’s prospects

Despite these challenges and shortcomings, Intel’s prospects remain strong. The company has registered strength in key segments such as CCG and DCAI, with the former reporting 31% revenue growth in the first quarter. CCG represents more than half of the company’s revenue, and recent successes have been driven by growth in desktop (+31%) and notebook (+37%) revenue. CCG is a business unit that provides consumer and commercial PCs, including desktops, laptops and related components.

Furthermore, Intel has ambitious plans to become the second largest third-party foundry by 2030, with significant orders already coming from companies such as Microsoft. Microsoft has already placed orders for the 18A process node, which arguably says a lot about the company’s direction.

According to reports, Intel has reserved all high NA EUV machines from ASML (ASML) and started deliveries in early 2024 – he was the first customer to do so. This is likely the reason for the higher capital expenditures in the first quarter, but it also gives Intel a good foundation to compete technologically in the future.

It’s also worth highlighting that many analysts believe Intel is best positioned to withstand geopolitical tensions and a possible attack on Taiwan – the island plays a central role in the global chip industry. That’s because Intel’s capacity in the US and its allies continues to dominate.

Cheap appreciation

Analysts’ earnings expectations for Intel are very strong. The company is expected to earn $1.08 per share in 2024, but this will rise to $1.92 in 2025, according to 38 analysts providing earnings forecasts. This figure rises again to $2.50 in 2026, according to ten analysts, and $3.18 in 2027, according to just two analysts.

At $31.36 per share, the stock currently trades at 29x non-GAAP forward earnings, which looks cheap compared to many of its peers in the chip sector. The caveat, however, is that many of his peers have been more exposed to the AI revolution. Nevertheless, Intel is still expected to grow earnings quickly – as noted above – and this leads us to a PEG ratio of 0.6x. That’s very tempting.

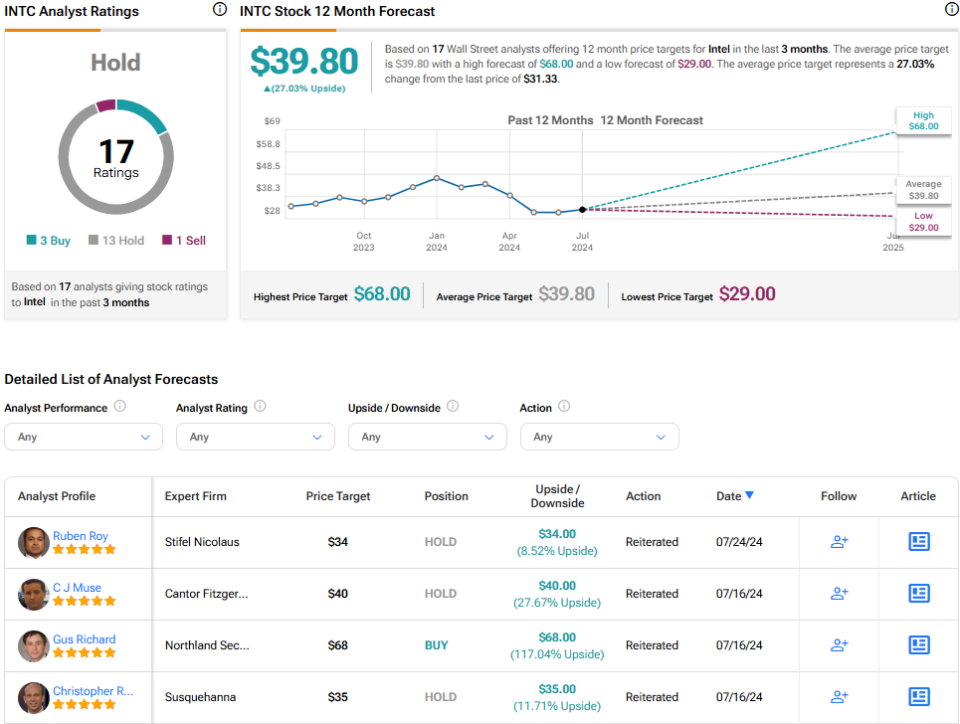

Is Intel Stock a Buy According to Analysts?

On TipRanks, INTC comes in as a Hold based on three Buys, 13 Holds, and one Sell rating assigned by analysts in the last three months. The average Intel price target is $39.80, implying an upside potential of 27%.

View more INTC analyst ratings

The result of Intel Stock

Intel’s earnings forecasts and valuation metrics are exceptionally attractive, and analysts’ expected upside reflects this. While the company’s track record isn’t great, I’m buoyed by its earnings forecasts and positive developments in the CCG and DCAI segments, making me bullish on the stock.