Table of Contents

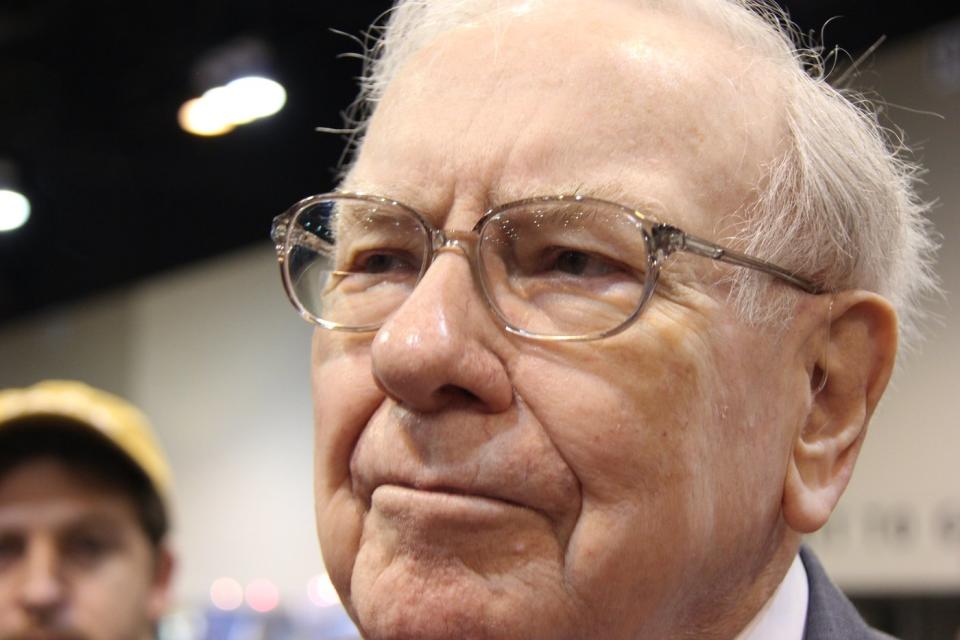

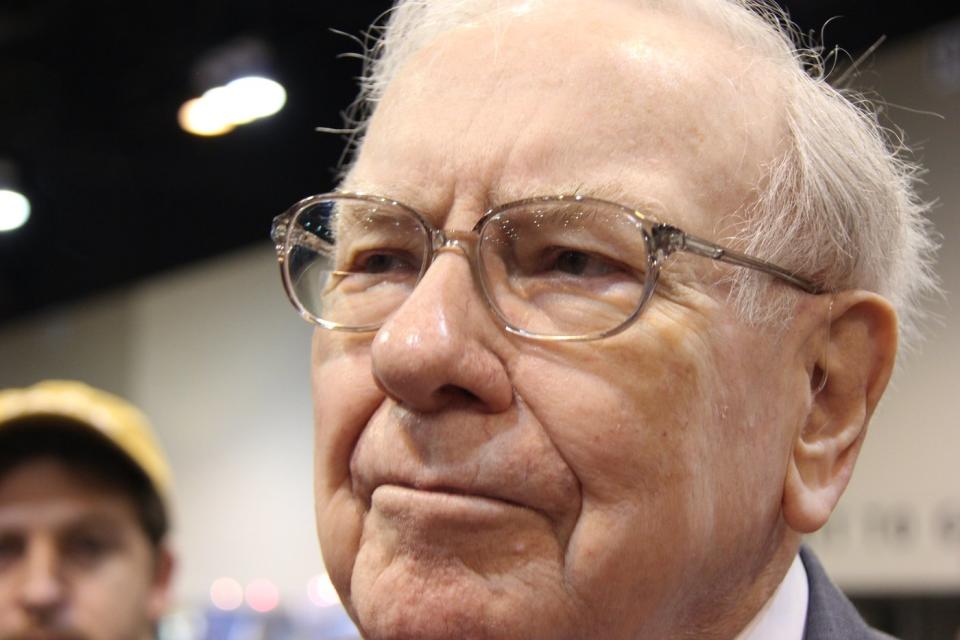

Warren Buffett has always loved stocks. However, there are periods when he liked them less. Now is one of those moments.

The legendary investor has been a net seller of shares for seven consecutive quarters. Are Berkshire Hathaway sold eleven shares in the second quarter of 2024. But one of them still seems like a good choice for income investors.

Buffett’s biggest sale in the second quarter was his cut of nearly half of Berkshire Hathaway’s position in U.S. equity Apple. However, despite aggressive sales, Apple remains the leader largest stake in Berkshire’s portfolio.

Two financial services companies have also fallen out of Buffett’s favor to some extent. Berkshire continued to sell shares Bank of America in the second quarter and also sold 21% of its stake Capital one financial.

The 94-year-old investor reduced Berkshire’s position Chevron (NYSE:CVX) by 3.6% in the second quarter. He also reduced the conglomerate’s holdings Liberty Media Class A And Liberty Media Class C each with less than 2%.

Other relatively modest sales for Berkshire in the second quarter included Floor & Decoration, Louisiana PacificAnd T-Mobile USA. However, he left Berkshire’s positions completely Big global And Snowflake.

Several dividend stocks in the mix

Income investors might say they’ve said goodbye to some of the stocks Berkshire sold in the second quarter. Floor & Decor, Liberty Media and Snowflake do not pay dividends.

Two others offer paltry dividends. From Apple forward dividend yield is only 0.44%, while Louisiana-Pacific’s future dividend yield is 0.97%.

Capital One Financial may be slightly more attractive to income investors with a forward dividend yield of 1.63%. T-Mobile US and Paramount Global pay even better dividends with yields of 1.73% and 1.89% respectively.

Buffett likes Bank of America less than in the past, but he has little to complain about the big bank’s dividend. BofA’s future dividend yield is 2.65%. The company recently increased its dividend payout by 8%.

The no-brainer purchase for income investors

However, there is one stock among those that Buffett sold in the second quarter that I think is a no-brainer buy for income investors. Chevron offers a juicy dividend yield of 4.58%. The company has increased its dividend for 37 years in a row.

Several factors could help Chevron in the near term. Lower interest rates should boost the US economy, potentially leading to an increase in oil and gas consumption. Tensions in the Middle East could keep oil prices high.

Looking a little further, an arbitration panel will hold a hearing next year to address a challenge raised by the commission ExxonMobil (NYSE:XOM) related to Chevron’s upcoming acquisition of Hess (NYSE: HES). Chevron CEO Mike Wirth said in the company’s second-quarter earnings call that he is confident of a positive outcome from this arbitrage.

Assuming Wirth’s optimism proves justified, Chevron’s acquisition of Hess should significantly expand and diversify the company’s portfolio of oil and gas assets. Most importantly for income investors, the transaction should also lead to increased cash flow and dividend payments to shareholders.

Demand for oil and gas is likely to remain strong for a long time, even with increasing adoption of renewable energy. Chevron is also investing heavily in carbon capture and storage technology. If these efforts are successful, the company’s long-term prospects will be extremely bright.

Buffett still likes Chevron, even though he sold some shares in the second quarter. If he didn’t, Chevron wouldn’t be Berkshire’s fifth-largest holding company. I think income investors should like this high-yield dividend stock as well.

Should You Invest $1,000 in Chevron Now?

Before you buy shares in Chevron, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Speights has positions in Apple, Bank of America, Berkshire Hathaway, Chevron and ExxonMobil. The Motley Fool holds positions in and recommends Apple, Bank of America, Berkshire Hathaway, Chevron and Snowflake. The Motley Fool recommends T-Mobile US. The Motley Fool has one disclosure policy.

Warren Buffett sold eleven shares in the second quarter. But 1 is still a no-brainer purchase for income investors. was originally published by The Motley Fool